city of richmond property tax inquiry

Real Estate and Personal Property Taxes Online Payment. Due Dates and Penalties for Property Tax.

Electronic Check ACHEFT 095.

. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Visa MasterCard and American Express. Late payment penalty of.

The City Assessor determines the FMV of over 70000 real property parcels each year. City of Richmond Parcel Tax Search. In Person at City Hall.

Monday July 4 2022. Search Any Address 2. Just Enter Your Zip for Free Instant Results.

Understanding Your Tax Bill. Report a Problem Request a Service. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

Find Richmond Online Property Taxes Info From 2022. While our partners work directly with the Treasurer to provide resources or link our ambassadors to the community. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

1 View Download Print and Pay Richmond VA City Property Tax Bills. Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. Billing is on annual basis and payments are due on December 5 th of each year.

Search by Parcel IDMap Reference Number. Get In-Depth Property Reports Info You May Not Find On Other Sites. If you are interested in serving as an Ambassador or Partner please.

Finance Taxes Budgets. Real Estate taxes are assessed as of January 1 st of each year. Richmond City collects on average 105 of a propertys assessed.

Expert Results for Free. Access City of Virginia Official Website. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

The propertys Parcel ID should be entered such as W0210213002. To pay your 2019 or newer property taxes online visit. Search by Property Address Search.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Manage Your Tax Account. Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or.

Circuit Court Clerk for the City of Richmond VA. Property Tax Vehicle Real Estate Tax. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

Real Estate Taxes are assessed on all land buildings and any other improvements attached to the land and completed as of January 1 st of each tax year. Other Services Adopt a pet. Ad Just Enter your Zip Code for Property Tax Records in your Area.

Selecting options for consulting taxes. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond. Easily Find Property Tax Records Online.

Property Taxes are due once a year in Richmond on the first business day of July. Richmond residents will have until July 4 to pay their property taxes. Virginia Judiciary Online Payment System VJOPS.

295 with a minimum of 100. See Property Records Deeds Owner Info Much More.

Boards And Commissions Richmond

Municipal Court City Of Richmond

11 Things To Know Before Moving To Richmond Va

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

With A Steep Property Tax Hike Looming Richmond Officials Weigh Shifting Some Of The Burden To Second Home Owners Central Berkshires Berkshireeagle Com

Pointe At River City Apartments Richmond Va 23223

Pointe At River City Apartments Richmond Va 23223

Redevelopment Planned For Richmond Town Square Property Wkyc Com

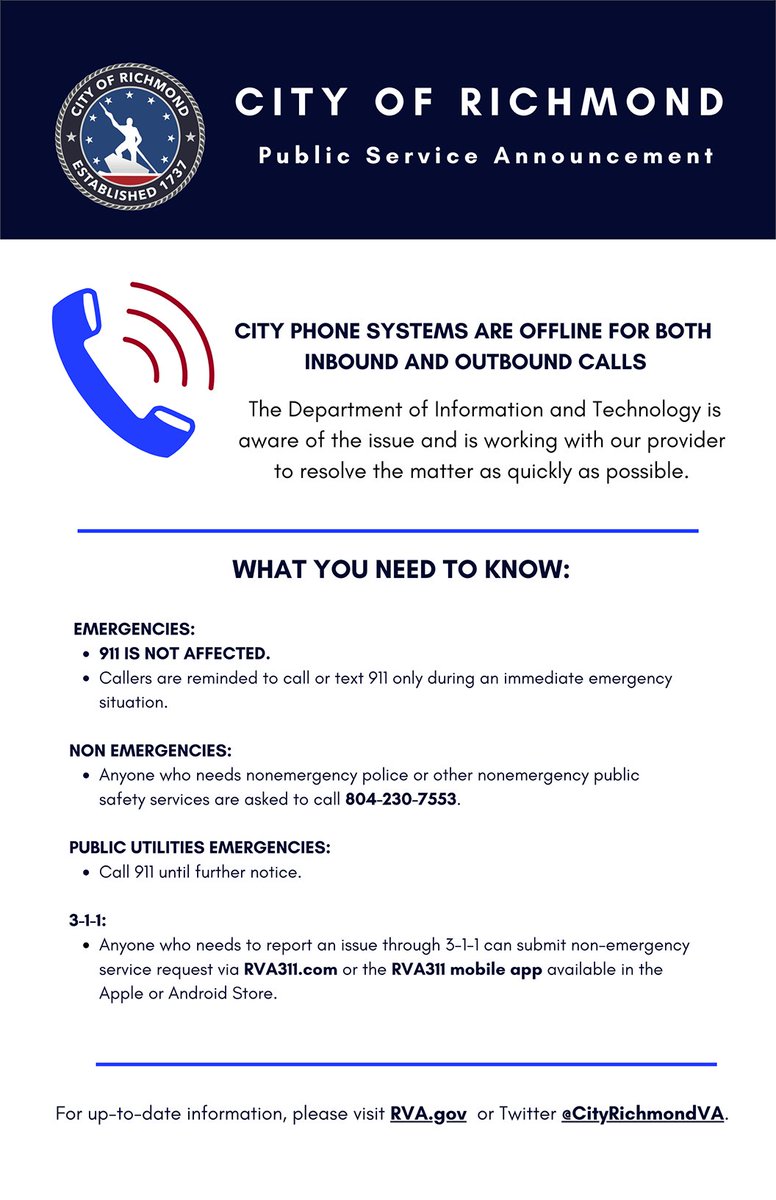

Covid 19 Response City Of Richmond

Preston Hollow Home Architect House Architect House Styles

/cloudfront-us-east-1.images.arcpublishing.com/gray/TEF2MJBWENB2HN5PYNKCP2LVYA.jpg)

You Could Be Paying More Property Taxes In Richmond Hill

Property Tax Billings City Of Richmond Hill

How 15 Canadian Cities Got Their Names Infographic Infographic City Canadian

/cloudfront-us-east-1.images.arcpublishing.com/gray/EBMY7FCFFRDJXHA4PGAPBYKLAI.jpg)